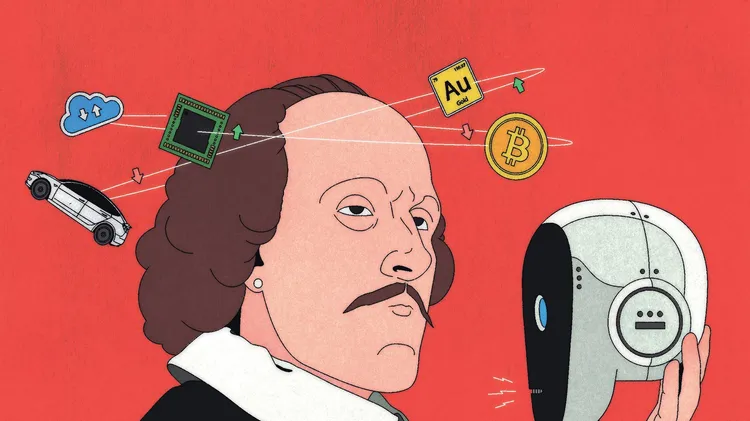

Spotting an era-defining trend is one route to outsized returns. Wh

Hunting for the big themes

2 min read

This article is from...

Read this article and 8000+ more magazines and newspapers on Readly