Words: Sarah Reid Illustrations: Ben The Illustrator

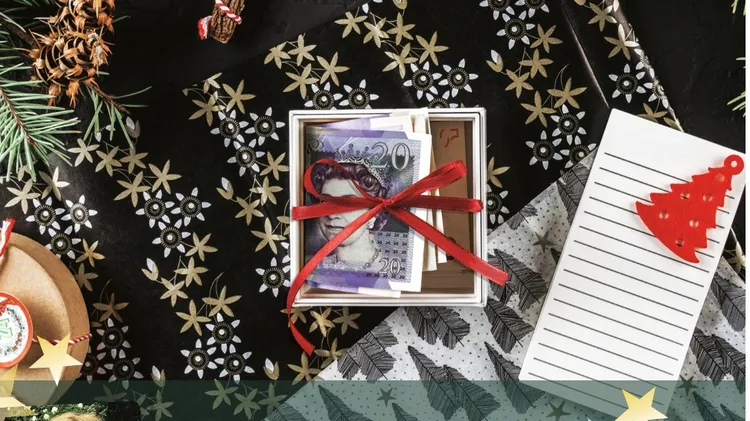

Let’s talk about money

4 min read

This article is from...

Read this article and 8000+ more magazines and newspapers on Readly